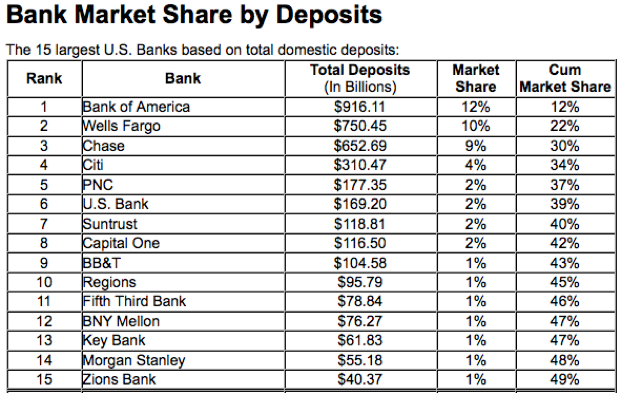

Chances are you have an account with a big bank. No, really. There is almost a 1 in 2 chance that you have an account with a Top 10 bank and a 1 in 3 chance that you have an account with one of the Top 3 largest banks.

So, there’s a pretty good chance you have an account with a major bank, and guess what?

There’s a pretty good chance you hate it.

Net Promoter Scores for the major banks are extremely low, with local banks and credit unions faring much better. And most likely if you do like your big bank, it’s because you happen to have a local branch that you like, not because you like the bank itself.

So, if people are so dissatisfied with their big banks, why do they stay? Usually when consumers are stuck with a large company they do not like, it is because of a lack of competitors in the space. However, the financial services industry in general and the banking industry in specific are highly competitive.

And still, most people act like they are handcuffed to their bank.

Not even a public outcry on the front page moves the needle that much. When a few months ago there was a public revolt against increased debit card fees, the big banks quickly backed down, causing the drama to disappear from the front page and a lot of the threatened attrition to evaporate.

Indications are that people will not be moving their accounts in any significant numbers in 2012. (link no longer active)

The only real question is why?

In my humble opinion, the reason most people stay in their unhappy banking relationships is what economists call switching costs or barriers to switching. Now barriers to switching can be substantial — such as a contract or geographic distance — but in the case of banking, it is rarely anything so clearly delineated. In the case of most banks, barriers to switching are what most of us call the hassle factor.

It costs almost nothing monetarily to switch banks. In fact, you will often save money by finding better deals and competitor incentives.

But a new toaster can’t buy you your life back.

Let’s look at some of the bank conveniences that make switching from any institution, but particularly a “big bank,” an incredible hassle.

You get the point by now, don’t you?

By the way, if you are a small business or franchise owner, double the hassle factor above for each business you own.

What is truly interesting about the above list is how much of a win it is for the banks. With the exception of more bank branches, every one of the conveniences above saves the banks money! Whether by design or by happy accident, the banks have given us greater convenience and at the same time increased their profit margins and trapped us in a prison of I-have-better-things-to-do than deal with switching banks right now.

So, if you are stuck with bad customer service and a tight pair of convenience-cuffs, what can you do? As far as your existing accounts, nothing much without some major hassles. The quicker you want out, the more hassle it will be. However, there are three things you can do to set yourself up for the future.

So, do you love your bank? Hate your bank? Have you stayed with a bank simply because of the hassle factor?

Comments are closed.

© 2011-2023 CTS Service Solutions, LLC.

All rights reserved.

Legal Information | Privacy Policy

How to Cite this Site

I use a community bank and can have lunch with the President (which I do). For my needs it makes it very convenient when my banker knows me personally. My kids in Ft Myers uses one of the big banks and it’s because they are somewhat still on the payroll so it makes it convenient for the wife to transfer the money. However, I hear her complain from time to time.

Just like in my business, if there isn’t enough pain or it appears to be more work than it’s worth it is very easy to do nothing. Like you said, gradually transitioning is sometimes the best approach if you need to make a move.

Good story and good info; thanks for sharing this. Hope all is well.

We are with one the monster ones; the service is pretty bad. Sure, the tellers are generally friendly and smile, but if you need anything remotely outside of the normal processes, be prepared for a lot of aggravation. We took some of the advice in this post ourselves. When we opened new accounts they were at a smaller regional bank, and the service has been much better.

Hold on to your banker friend! In my home town, we used to have some of those personal relationships, and they are invaluable when you can find them. What is interesting is how many of those disappeared over time as banks were bought up and merged.

Test comment

I love our bank, and it’s a large one. But it’s not on that list, which is actually a relief. I think we all learned a lot last year about the power these large banks hold over our economy, and frankly, I don’t know what we can do as citizens to unravel the mess.

I’ve seen some advisors telling folks to pull their accounts from large banks and sign on with small banks and credit unions, but wouldn’t that cause a replay of last year, with even more dire consequences this time?

Hey Michelle, Glad to hear you like your big bank, but if it’s not on the list, then at least it isn’t super-size! 🙂

I’m not sure what can be done as citizens. I will say this… (and I’m no economist) I don’t think there would be a huge impact to the general economy if people moved their accounts from large banks to smaller institutions provided 1) it happened over time and not in a big panic and 2) they actually did move the money to another bank and did not stick it under the proverbial mattress.

PS. If you want to stay up late at night worrying about this stuff, watch Too Big To Fail on HBO. They did a remarkable job with it. Superbly written and acted.

Hi Adam,

I have been with the same bank for over 15 years and my wife uses her credit union for hers. As long as I get “good” service when dealing with a bank I will stay. Avoid BOA at all costs.

You know Justin, everyone I meet that uses a credit union is generally satisfied. I’ve just never taken the leap myself.

Thanks for stopping by!

Hilarious. You never mentioned getting all those checks reprinted. Am I the only jamoke who still writes checks? In fact, I don’t allow auto debit from my account unless I absolutely must or risk not having my service?

You’re so right about everything you said! Love this post, too. Everyone can relate to it. And, you know what else? That Huntington Bank wants to give me $100 to switch and the only reason I won’t is because I can’t find a branch that’s convenient!

My primary accounts are with an insurance company that duals as a bank; guess what? I mail my checks or take digital images of my checks and send them in for deposit. No need to leave my house and find a darn drive up teller. Love that.

Thanks so much Jayme! Hah, I missed one of the most obvious ones — paper checks. We definitely still use paper (and like you, are very careful and reluctant with auto-debit). And it’s funny you mention it, because the last time we reordered checks, my wife had such an absolutely terrible experience that I almost wrote about it in Customer Service Stories.

I’ve never tried the digital image thing (seen the commercials) but it sounds like another convenience that keeps us from moving and saves the bank costs.

Thanks for stopping by!

That is so true Adam. As an author and business man, I can relate to how you said “When a few months ago there was a public revolt against increased debit card fees, the big banks quickly backed down, causing the drama to disappear from the front page and a lot of the threatened attrition to evaporate”. I hope more people discover your blog because you really know what you’re talking about. Can’t wait to read more from you!

Hi Daniel, Thanks so much for the kind words and for stopping by my blog! Look forward to talking more in the future.

Thanks for the great article. In these uncertain economic times, some banks are certainly feeling the pressure and are passing it onto consumers in the form of fees, inconvenience, and poor customer service. Great suggestions here.

Well said Ryan. Thanks for stopping by!

Pingback: How Good Marketing Can Create Bad Customer Service

One of the reasons I stuck it out with my bank is the ATMs that are abound. Convenience does factor in a lot. But I guess another reason people don’t switch is because they probably just dismiss banks to be all alike anyway. Of course, this kind of mentality can change if they make the effort to do a little research so they can make an informed decision.

Hi Rye, thanks for taking time to share your thoughts. You make a good point that a lot of people probably just assume that banks are almost commodities, and there aren’t a lot of differences between them. That presents a great opportunity for banks to differentiate themselves.

Pingback: Monthly Mash and How Often Should We Blog?

Pingback: 4 Customer Service Trends for 2013

Pingback: How Customer Service Can Save Cable